FROM IMPULSE BUYS TO LONG-TERM GAINS: RETHINKING BLACK FRIDAY

By Marilize van Zyl, Head of Manager Resarch

December 2025

Every November, shoppers across South Africa gear up for one of the biggest retail events of the year – Black Friday. Digital carts fill up before sunrise, checkout lines stretch across store aisles, and bank cards tap endlessly through the day.

In 2024 alone, South Africans spent more than R30 billion in one weekend – with purchases ranging from everyday essentials to luxury splurges. One shopper even spent R780,000 at Cartier (1) , a headline that captured the country’s attention.

But it raises a powerful question: What if some of that spending had been invested instead?

The R780 000 question

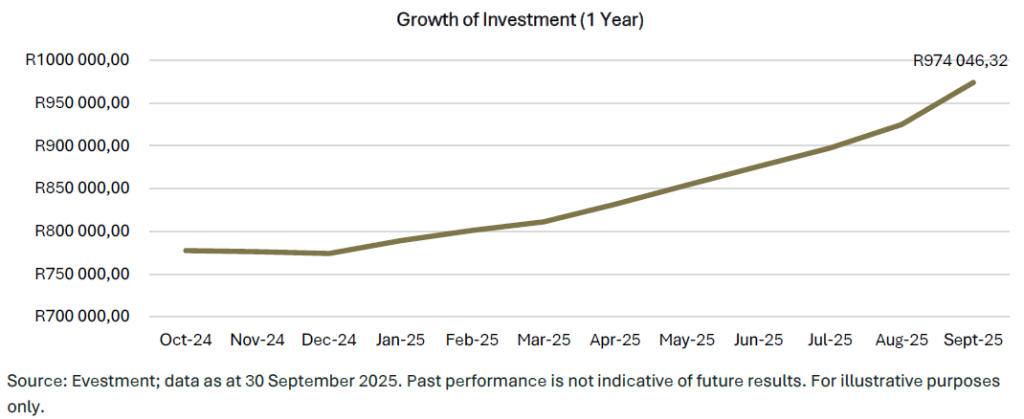

Let’s imagine that instead of spending R780 000 on a luxury item last year, that shopper invested the same amount in the Optimum BCI Equity Fund, which returned 24.88% over the past year.

By September 2025, that once-off splurge would have grown to approximately R974 000 – a gain of nearly R194 000 earned quietly and effortlessly over time.

The real Black Friday basket

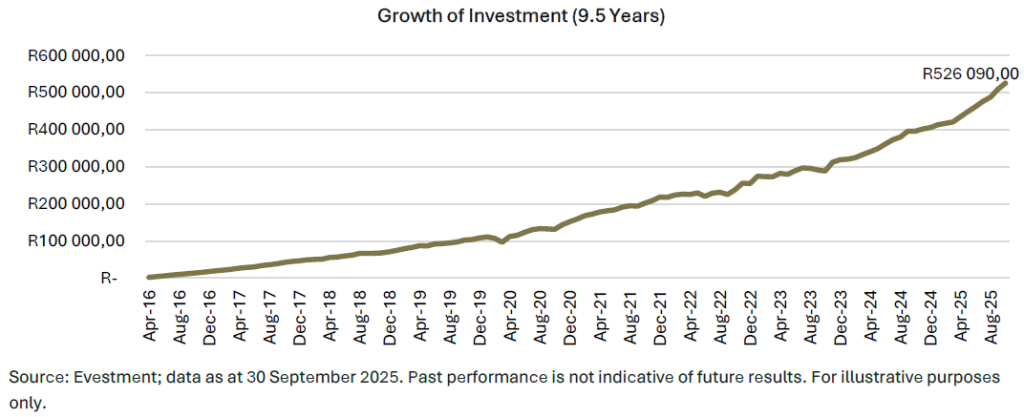

According to PayU GPO, the average South African spent R1 946 per Black Friday basket in 2024 which is a 5% increase from the year before. (2)

If that same R1 946 were invested monthly into the OIG High Equity Return Option for ten years (with a 5% annual escalation), it would have grown to over R530,000 thanks to the power of compound interest.

That’s the real bargain: small, consistent investments with years to grow.

Why we so eagerly spend on Black Friday?

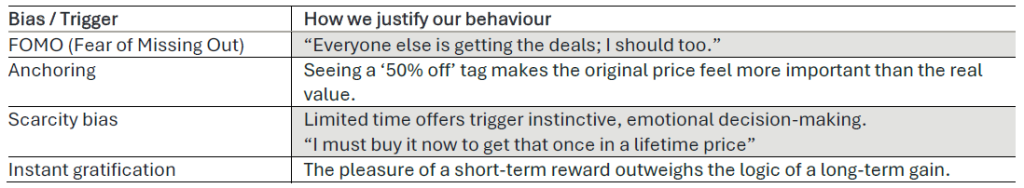

Black Friday plays directly into some of our strongest behavioural biases. These biases don’t signal failure – they simply remind us that humans are wired for emotion-first decisions. Recognising the pattern is the first step toward building healthier financial habits.

Examples of these behavioural biases include:

If you overspent this Black Friday – here’s how to turn it into a win

Instead of feeling guilty, consider this season a learning opportunity. There are practical, financially smart steps you can take right now to reset and refocus.

-

Review your behaviour, not just your bank balance

Look back at what triggered your purchases: Was it a genuine need? A limited-time special? Emotional excitement? Social influence? Understanding your patterns helps you anticipate them next time and build systems to manage them.

-

Create your “Not this year” list

Write down the purchases you regret. These become powerful behavioural “guard rails” for next year, reducing impulse spending and helping you redirect funds to investment goals.

-

Upsell or thrift your way back

If you bought more than you needed, consider selling unused items online, packaging goods into bundles, offering them at a slight markup if still sealed or in high demand. Turn spending mistakes into value by swapping with friends or on trusted community platforms, thrifting items you wish you’d bought instead, and/or negotiate better prices or store credits. This not only saves you money, but it also strengthens your future buying discipline. These are also simple ways to recover cash while tapping into entrepreneurial thinking.

-

Channel the ‘shopping energy’ into investing energy

If you set aside even a portion of what you spent – say 10-20% – and commit to investing it monthly, you replace a short-term cycle with a long-term habit.

A mindset shift that pays dividends

Ultimately, Black Friday doesn’t need to be a once-a-year spending sprint – it can be an annual checkpoint. A moment to reflect on your financial habits, recognise the emotional triggers that influence your decisions, and recommit to the long-term investing goals that build real wealth. It’s also an opportunity to tap into your entrepreneurial mindset when money feels tight and to use behavioural insights to make smarter choices throughout the year.

A small shift in thinking today can shape a far brighter financial future. So, before you hit “Add to Cart” next November, pause for just a moment and ask yourself: Would I rather own this today, or grow something bigger for tomorrow?

(1) Source: Moonstone.co.za, Black Friday 2024: South African shoppers go digital amid record spending. Published 17 December 2024.

(2) Source: Businesswire.co.za; PayU GPO Data Shows Black Friday 2024 Reached New Heights in Africa. Published 2 December 2024.

Disclaimer

Although reasonable steps have been taken to ensure the validity and accuracy of the information in this document, Optimum Investment Group (OIG) does not accept any responsibility for any claim, damages, loss or expense, however, it arises, out of or in connection with the information in this document, whether by a client, investor or intermediary.

Optimum Investment Group (Pty) Ltd. Is an Authorised Financial Services Provider (43488).

All investments involve risk, including the potential loss of principal. There is no assurance that any financial strategy will be successful. OIG does not guarantee that the results of any advice, recommendations, or strategies will be achieved. Before making any investment decisions, customers should thoroughly review all relevant investment product documents and information. It is essential to assess whether an investment aligns with your financial situation, objectives, and risk profile.

This document may contain forward-looking statements identified by terms such as “expects,” “anticipates,” “believes,” “estimates,” “forecasts,” and similar expressions. These statements involve risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. OIG is not responsible for any trading decisions, damages, or other losses resulting from the use of the information, data, analyses, or opinions provided.

Past performance does not guarantee future results. Neither diversification nor asset allocation ensures a profit or protects against a loss.

The information, data, analyses, and opinions presented herein are for informational purposes only and do not constitute investment advice or an offer to buy or sell any security. References to specific securities or investment options should not be considered an offer to purchase or sell those investments. The performance data shown reflects past performance and is not indicative of future results.

The opinions expressed are those of OIG as of the date written, are subject to change without notice, and do not constitute investment advice.